When you hear the term “operational risk,” it’s easy to tune out. It often sounds like some vague, corporate buzzword that gets tossed around in boardrooms but doesn’t mean much on the ground.

But let’s be real. Operational risk isn’t some abstract theory. It’s the very real possibility of losing money because of breakdowns in the things that make your business run: your people, your processes, and your systems. It’s the tangible, everyday stuff that can bring productivity to a screeching halt and punch a hole in your bottom line.

This isn’t about the whims of the stock market or high-level strategic pivots. We’re talking about the gut-wrenching scenarios that keep managers up at night.

What Does Operational Risk Actually Look Like?

Think about it in concrete terms. Have you ever experienced something like this?

- Human Error: A seasoned employee has a momentary lapse and enters the wrong data into a critical financial report. Suddenly, your whole team is making decisions based on flawed information.

- Process Failure: Your entire production line depends on a single supplier for a key component. One day, they go out of business without warning, and your operations grind to a halt.

- System Failure: Your e-commerce site crashes due to a software bug right in the middle of your biggest sales event of the year.

These aren’t just minor hiccups; they are operational failures with immediate and severe financial and reputational damage. Unlike market or credit risks that are tied to big, external economic forces, operational risk is an inside job. It’s everything from a server fire to a simple typo.

To get a better sense of how these risks are categorized, especially in high-stakes environments, it’s worth exploring a detailed breakdown of these risks in financial settings. The principles apply almost everywhere.

To get a clearer picture of these risks, let’s break down the common categories and what they might look like in your own business.

Key Sources of Operational Risk

| Risk Category | What It Means for You | A Real-World Scenario |

|---|---|---|

| People Risk | Mistakes, fraud, or unavailability of key personnel. | Your lead developer, the only one who understands a legacy system, goes on an unplanned extended leave, halting a critical project. |

| Process Risk | Flawed or broken internal procedures and controls. | A poorly designed approval workflow for expenses leads to duplicate payments and budget overruns before anyone notices. |

| Systems Risk | Failures or disruptions of hardware, software, or networks. | Your company’s CRM goes down for a full day, leaving your sales and support teams completely blind and unable to help customers. |

| External Events | Things outside your control, like natural disasters or supply chain disruptions. | A major shipping lane gets blocked, delaying the arrival of essential raw materials and forcing you to halt production. |

This table isn’t just a list of bad things that can happen; it’s a map of your business’s vulnerabilities. Each one of these scenarios is a preventable fire.

The whole point of managing operational risk is to shift from being a firefighter to being an architect. You stop reacting to disasters and start building a business that’s fundamentally more resilient from the ground up. In today’s world, a reactive strategy is a failing strategy.

The Real Cost of Doing Nothing

Ignoring these risks is, frankly, choosing to accept preventable losses. When a critical process depends entirely on one person who suddenly isn’t there, work stops. It’s that simple. When a system isn’t maintained, it’s not a question of if it will fail, but when.

Proactively tackling operational risk means digging in, finding these weak spots, and putting smart controls in place to buffer the impact. This isn’t just about avoiding disaster; it’s about building a solid foundation for stability, efficiency, and growth that can weather any storm.

Building Your Risk Management Framework

Let’s be honest, a solid framework for managing operational risk is much more than a document that sits on a shelf collecting dust. Think of it as your organization’s living, breathing playbook for building resilience. And where do you start? Not with spreadsheets, but with people.

Specifically, you need to get buy-in from senior leadership. When executives are visibly championing risk management, it sends a powerful message across the entire company: protecting the business is everyone’s job.

This leadership support is absolutely critical for the next conversation you need to have: defining your company’s risk appetite. This isn’t just some technical jargon; it’s a fundamental strategic decision. You’re basically asking, “How much risk are we willing to stomach to hit our business goals?”

There’s no one-size-fits-all answer here. A high-growth tech startup might be comfortable taking on risks associated with brand-new technologies, while a financial institution will, for obvious reasons, have a much lower tolerance for data errors. Getting this definition right helps every single team make consistent, aligned decisions.

What Goes Into the Framework?

Once you’re clear on your risk appetite, it’s time to build out the practical guts of your framework. This isn’t about creating more red tape; it’s about establishing clarity and accountability. From my experience, a robust framework always boils down to a few key components.

- Clear Policies and Procedures: These are the guardrails for your day-to-day operations. They need to be simple, easy to find, and—this is key—regularly updated.

- Defined Roles and Responsibilities: Who owns what? Everyone from the front-line staff to the C-suite needs to know their exact role in spotting and handling risk. Who owns a particular risk? Who is responsible for the control that mitigates it?

- Open Communication Channels: Your team has to feel safe escalating potential issues without fearing blame. A near-miss that goes unreported is just a future disaster waiting to happen.

The real value of a framework is measured by how it’s used in daily operations, not its theoretical perfection. If your people don’t get it or can’t apply it easily, it has already failed. It should make doing the right thing the easy thing.

Making Your Framework a Reality

With the core components in place, your focus needs to shift to integration and continuous improvement. Your framework can’t be static; it has to be a dynamic system that adapts to new threats and business changes. This is all about embedding risk management into your company’s DNA.

For instance, when your team is planning a major system migration, the project plan should include a formal risk assessment right from the start. When a department experiences repeated process failures, a post-mortem isn’t just for finger-pointing—it should feed insights back into your framework to strengthen your controls.

This is where your framework starts to connect with other critical practices. For a deeper look into keeping operations running smoothly during disruptions, our guide on IT service continuity management offers some great strategies that dovetail nicely with what we’re talking about here.

Ultimately, a well-built structure transforms how you manage operational risk. It moves you from a reactive, firefighting mode into a proactive, strategic posture that protects your bottom line and your reputation.

How to Identify Your Hidden Operational Risks

You can’t manage operational risk effectively until you know exactly what you’re up against. The most dangerous threats are almost always the ones lurking just beneath the surface of your daily workflows—unseen, unaddressed, and waiting to cause problems. Uncovering these hidden vulnerabilities requires a proactive, hands-on approach that gets your entire team involved.

The goal isn’t to create a perfect, exhaustive list on day one. It’s about kicking off a continuous process of discovery. This starts by empowering the people closest to the work. They are your best source for identifying where processes might fail or where a single point of failure exists.

Start with Collaborative Workshops

One of the most effective ways I’ve seen to surface these risks is through collaborative workshops. Forget dry, top-down directives. Instead, gather cross-functional team members in a room and ask a simple, powerful question: “What could go wrong in our process that would stop us from doing our jobs or serving our customers?”

These sessions, often called Risk and Control Self-Assessments (RCSAs), aren’t about placing blame. They are about collective problem-solving. When people feel safe to speak up, you’ll be amazed at the insights they share—from the clever workarounds they’ve created to deal with buggy software to genuine concerns about relying on a single person for a critical task.

To bring some structure to these sessions, you can use a comprehensive bank risk assessment template to guide the conversation. Even if you’re not a bank, the structured questions are fantastic for sparking important discussions and making sure you don’t miss anything obvious.

Map Your Critical Processes

Another powerful technique is process mapping. Visually charting out a critical workflow from start to finish forces you to examine every single handoff, system dependency, and decision point along the way. As you map the process, start asking questions at each stage:

- What data is needed here? What happens if it’s inaccurate or unavailable?

- Who is responsible for this step? Is there a backup person trained to do it?

- What system is used? What’s our plan if that system goes down?

This kind of visualization often reveals bottlenecks and dependencies you never knew existed. For instance, you might discover that a critical customer report relies on data from three different systems, and a failure in any one of them could bring the entire process to a screeching halt. This is especially true when it comes to safeguarding sensitive information; our guide on how process mapping can protect one of your most vital assets dives deeper into this.

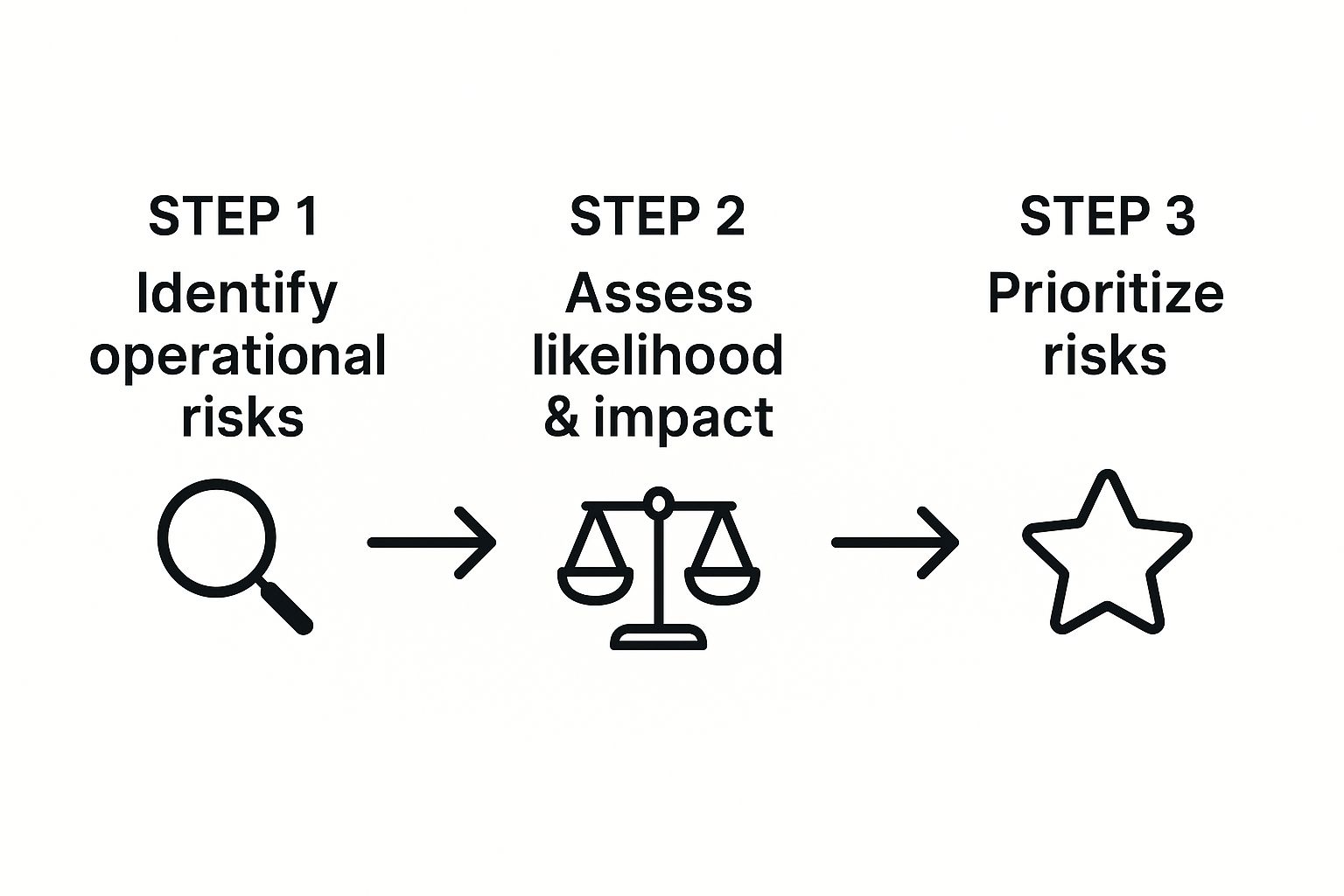

The visual below illustrates the core flow of this discovery and prioritization process.

This simple flow—identify, assess, and prioritize—is the bedrock of any solid risk management strategy.

Prioritize with an Impact and Likelihood Matrix

Once you have a list of potential risks, you’ll quickly realize you can’t tackle them all at once. It’s just not practical. This is where a simple but incredibly effective prioritization tool comes in: the impact-versus-likelihood matrix.

For each identified risk, you’ll assess two things:

- Likelihood: How probable is it that this event will happen? (e.g., low, medium, high)

- Impact: If it does happen, how severe would the consequences be for the business? (e.g., minor, moderate, catastrophic)

Plotting these risks on a simple grid immediately shows you where to focus your energy. A high-impact, high-likelihood risk is a ticking time bomb that needs immediate attention. On the other hand, a low-impact, low-likelihood risk can probably wait. This tool transforms a long, overwhelming list into an actionable roadmap.

Confronting Modern Cybersecurity Threats

You don’t need a crystal ball to see that cybersecurity has become one of the biggest operational risks for any business. The financial and operational fallout from a single breach can be devastating, making a solid defense strategy absolutely essential.

Gone are the days when cybersecurity was just a problem for the IT department. Now, it’s a board-level concern. A breach isn’t just about lost data; it can bring your operations to a screeching halt, damaging your bottom line and your reputation. A firewall and some antivirus software just don’t cut it anymore.

The threats we’re facing are more sophisticated and costly than ever. Ransomware-as-a-service models, like Medusa, use simple phishing tactics to steal credentials and hold your company’s data hostage. The financial stakes are high, with IBM reporting the average data breach cost climbed to $4.88 million, up from $4.45 million in 2023.

Building a Layered Cyber Defense

So, how do you manage this risk? You need a defense-in-depth strategy. It’s like defending a fortress; a strong outer wall is a good start, but you also need a moat, guards, and secure inner keep.

A strong defense often starts with the basics, which get overlooked more than you’d think.

- Consistent System Patching: Unpatched software is a wide-open door for attackers. Make timely updates a mandatory policy for every system and application. No exceptions.

- Enforce Multifactor Authentication (MFA): Stolen passwords are a hacker’s dream. MFA adds that critical second layer of security, making it exponentially harder for bad actors to get in, even if they have a password.

- Employee Security Training: Your team is your first and most important line of defense. Regular, engaging training on how to spot phishing attacks and other social engineering schemes provides one of the best returns on your security investment.

A layered defense isn’t about being impenetrable—it’s about being resilient. It ensures that if one security control fails, another is ready to stop or slow an attack. The hard truth is that disruptions are inevitable; how you prepare for them is what matters.

Proactive Monitoring and Response

Beyond just preventing attacks, you need to be able to spot and respond to them. This means having real-time threat monitoring to catch unusual activity as it happens, not after the damage is done.

And when an incident eventually occurs—because it will—having a well-rehearsed response plan is crucial. This is where your cybersecurity strategy links directly to your overall operational resilience. For a comprehensive walkthrough, take a look at our guide on incident management best practices. A quick and effective response can make all the difference in minimizing the financial and reputational fallout from a breach.

Practical Ways to Mitigate and Control Risk

Once you’ve identified your operational risks, the real work begins. An identified risk that isn’t acted upon is just a known vulnerability. The next step is moving from analysis to action, which means making a conscious decision about how to handle each threat you’ve uncovered.

At its core, every risk response strategy falls into one of four categories. Understanding these options gives you a clear playbook for protecting your operations.

- Avoid: This is about stopping the activity that creates the risk altogether. If a new piece of software is too buggy and unstable during testing, you might simply decide to avoid the risk by not implementing it.

- Reduce: This is the most common approach. You implement controls to lower the risk’s likelihood or impact. A classic example is enforcing multi-factor authentication to reduce the chances of unauthorized account access.

- Transfer: This involves shifting the financial blow of a risk to a third party. Buying cybersecurity insurance is a perfect example of transferring risk.

- Accept: Let’s be honest, sometimes the cost of mitigating a risk is way higher than its potential impact. For low-impact, low-likelihood risks, you might consciously decide to accept it and move on.

The right strategy really depends on your company’s risk appetite and the specific situation. A risk that one company chooses to accept, another might spend significant resources to reduce.

Designing Effective Internal Controls

After you’ve picked your strategy—which, most of the time, will be to reduce the risk—you need to design and implement internal controls. These aren’t just about creating more rules. They are practical safeguards woven into your daily workflows to prevent errors and disruptions before they happen.

Effective controls don’t have to be complicated. They can be as simple as a pre-flight checklist for a product launch or as sophisticated as an automated alert in Jira that flags when a high-priority ticket is about to breach its SLA because it’s unassigned.

The goal is to make controls a natural and seamless part of how your team works. If a control is too cumbersome or feels like a bureaucratic hurdle, people will inevitably find ways to work around it, defeating its entire purpose.

From Manual Checks to Automated Safeguards

Your controls should evolve right alongside your business. What starts as a manual process can, and often should, be automated as you scale. This increases both efficiency and reliability.

Let’s take a common operational risk: a key team member goes on vacation, creating a single point of failure for approvals.

- A Manual Control: A manager has to remember to manually reassign that employee’s open Jira tickets before they leave. This is better than nothing, but it’s wide open to human error—tasks can easily be missed in the rush.

- An Automated Control: Using an app, you can set up absence rules that automatically reassign all incoming issues and pending approvals to a designated backup person the moment the primary employee is out of office.

This kind of automation transforms risk management from a manual, error-prone chore into a reliable, invisible process that protects your workflow. It’s also a critical piece of your overall business resilience strategy. To learn more about maintaining operational uptime, you can explore ways to improve business continuity with smart preparation.

Finally, remember that controls aren’t “set it and forget it.” You have to test them regularly to make sure they’re still working, especially after you make big changes to your processes or systems. Regular testing ensures your defenses stay strong as your business evolves.

Learning from Others to See Around Corners

The most resilient businesses get one thing right: managing operational risk isn’t a solo sport. They know that no matter how good their internal view is, it’s still just one perspective. If you really want to get ahead of future disruptions, you have to look outside your own four walls and learn from what’s happening across your industry.

This isn’t just about playing defense. It’s about turning risk management into a strategic advantage. Instead of getting blindsided by a new threat, you can spot emerging issues as they hit other companies and get your own defenses ready before it’s your turn.

The Power of Industry Benchmarking

How does your company’s risk profile stack up against your peers? Answering that question is what industry benchmarking is all about. This isn’t about blindly copying what competitors are doing. It’s about gaining context.

Are you pouring resources into mitigating a low-probability risk while completely missing a threat that keeps other leaders in your field up at night?

Getting involved in industry forums, roundtables, and consortiums can provide invaluable, real-world data. A fantastic example is the collaborative research from organizations like ORX. They brought together over 47 leading global firms to identify emerging operational risks.

By pooling their knowledge, they pinpointed key threats on a 12 to 36-month horizon. This allowed every participant to see how their own risk perceptions compared to the industry average. You can see how this gives members a massive leg up by checking out the full findings on the ORX website.

By seeing what others see, you can start to see around corners. This shared perspective is one of the most powerful tools you have for identifying blind spots in your own operational risk management strategy before they become costly problems.

Turning Shared Insights into Action

Gathering this kind of external intelligence is just the first step. The real magic happens when you turn those insights into concrete actions that strengthen your own internal processes and controls.

For example, if you learn from an industry report that supply chain disruptions in a specific region are becoming a major headache, you can start proactively vetting alternative suppliers. If a new type of social engineering attack is making the rounds, you can update your employee training right away.

This is where your internal documentation becomes absolutely critical. Well-defined procedures are what allow you to adapt quickly and integrate these new learnings. If your processes are vague or undocumented, trying to react to emerging threats becomes a slow, chaotic mess.

If you’re looking to shore up this area, our article on the benefits of documenting business processes is a great place to start building a more agile operational foundation.

When you combine a strong internal framework with a curious, outward-looking mindset, you create a powerful cycle of continuous improvement. This approach doesn’t just help manage operational risk—it builds a more forward-thinking and resilient organization ready for whatever comes next.

Got Questions About Operational Risk?

Diving into operational risk management always brings up some practical, on-the-ground questions. We get it. Here are some of the most common ones we hear, along with straightforward answers from our experience.

How Often Should We Review Our Operational Risks?

While a big, formal review once a year is a solid baseline, you can’t just set it and forget it. The best risk management is a living, breathing part of your day-to-day operations—not just an annual event.

For fast-moving areas like cybersecurity, you should be checking in quarterly or even monthly. More importantly, some events should trigger an immediate review, no matter when your last one was. Think of these as red flags:

- You’re rolling out a major new system or piece of tech.

- You’re making a big change to a core business process.

- You have a “near-miss”—an incident that could have been a disaster but wasn’t.

What Is the Biggest Mistake Companies Make?

By far, the most common pitfall is treating operational risk as a pure compliance exercise. It’s the “check the box” mentality. When your risk assessment becomes just another report to file away, it loses all its real-world value and just becomes a bureaucratic chore. The document isn’t the point.

The real goal isn’t to produce a flawless report. It’s to build a resilient culture where everyone, at every level, feels empowered to spot and flag risks as a normal part of their job.

Can a Small Business Realistically Manage This?

Absolutely. In fact, small businesses often have a huge advantage: they’re nimble. You don’t need a huge, dedicated risk department or fancy enterprise software to make a real impact on your operational risk.

The trick is to start simple and focus your energy where it counts. Kick things off by identifying your top five operational risks—the handful of things that would genuinely cripple your business if they happened. Then, put all your effort into creating simple, low-cost controls for just those areas. The core ideas of risk management scale perfectly, whether you’re a team of five or five thousand.

Absences are a classic source of operational risk, but they don’t have to derail your team. With resolution Reichert Network Solutions GmbH, you can set up automated handovers in Jira, making sure workflows keep moving even when someone’s away. Take control of your team’s availability and safeguard your productivity by checking out our Out of Office Assistant for Jira.